Alternative investments, like art and collectibles, to diversify your portfolio can often seem daunting when approached from a place of inexperience.

But it doesn’t have to be that way. With great risks come even bigger rewards and art investment can pay off big time if you work with professional and credentialed advisors, dealers, and appraisers.

As art collectors, my partner and I have spent the last several years working with reputable galleries and appraisers to ensure that we were buying with our hearts but with an educated heart. We have learned this along the way.

Is The Risk Worth It?

Like investing in the traditional stock market, there will always be risks when investing in art. Counterfeits and forgeries still occur in the art world, and with better technology, it has become more challenging for professionals to identify fakes. Of course, there is the volatility of the market in general, and art appreciation can be cyclical.

Forgeries and Counterfeits

I recently spoke with Heritage Auctions Senior Vice President and Director of American Art, Aviva Lehmann, to learn more about mitigating the risks associated with art investments. She shared, “There is always a concern of fakes, forgeries, and misrepresentation by a seller. Therefore, only work with reputable houses and advisors. Do your homework.”

Databases such as ArtNet or askArt are also great resources for researching the artist and their work.

Costs and Fees

If your goal in investing in Blue Chip art is to hold onto your collection for a while, then you most likely will see the pieces’ value appreciate. But that isn’t always a guarantee, and you might not see a high return, especially considering the amount you will pay in costs and fees related to appraisals, insurance coverage, storage, maintenance, and restoration.

Tax Obligations

If your art collection appreciates and you choose to sell any of your pieces, the capital gains sales tax is a hefty 28%; however, if you sell the piece within a year of purchasing it, it will be taxed as ordinary income. Before selling any of your artwork, Lehmann advises to “Always get multiple opinions from at least two reputable dealers or auction houses. Don’t make a rash decision—always do your homework and find the ideal selling venue for your particular material.”

Lack of Information and Comps

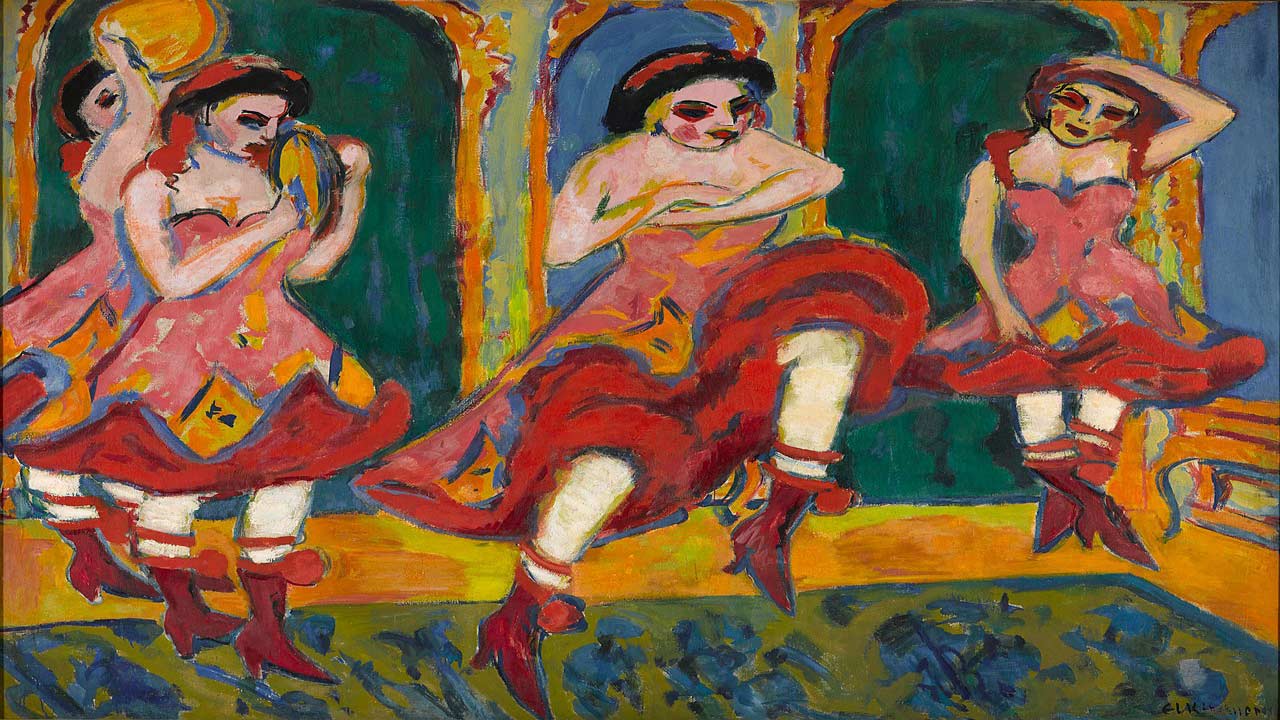

Unlike trading stocks, bonds, and commodities, investing in art only sometimes comes with an upfront comp sheet for a proper analysis. According to Lehmann, “certain blue-chip artists in the American Art arena (such as Georgia O’Keeffe and Norman Rockwell) remain strong and consistent. Other areas fluctuate in cycles.”

Due to this uncertainty, art can be a gamble. However, art investment isn’t always about the return; it’s more about the love of the piece and having something incredible to hang on your wall to admire daily.

Rewards of Art Investment

Many rewards come with investing in art, but most importantly, having a beautiful creation in your home is the biggest. Whether it appreciates or depreciates, your original piece can enrich the lives of others and be enjoyed for generations to come.

Diversifying Your Portfolio

Diversification is a risk management strategy that involves spreading your investments across different types of assets, such as stocks, real estate, and alternative commodities like art and collectibles. Because art does not traditionally move in sync with the economy or stock market, it is a good candidate for diversification because it has a low correlation with other asset classes.

Appreciation Potential

There are many factors at play when it comes to the potential of art appreciation. Many of them are related to current trends and what people are seeking, according to Lehmann. “Early American Modernism remains strong. But I will say that the hottest trend in collecting revolves around diversity. Women artists and artists of color are HOT HOT HOT! We are seeing this trend not only in the auction arena but also in the retail/gallery world.”

Those old Hudson Valley landscapes might not be worth the investment.

Tangible Assets

According to Faster Capital, “art is more than just a form of expression. It is also a tangible asset that can be bought and sold, and as such, it has the potential to become a valuable investment.” Because art is tangible, it makes it a liquid asset, meaning you can convert your object into cash, making it valuable in times of financial need.

Evaluation of Art

Lehmann continued, “Condition, rarity, provenance, quality, and current market taste all play a role in art appraisal and evaluation. It is most important that a collector works with a reputable and experienced art advisor with years of experience. Collecting is far more enjoyable and safer when you spend the time learning about what you are collecting before getting your feet wet. Auction house specialists are always available to guide and advise new collectors.”